Meta revenue for Q3 2024 reaches $40.59 billion

Meta has reported impressive financial results for the third quarter of 2024, showcasing the company's continued growth and dominance in the social media landscape.

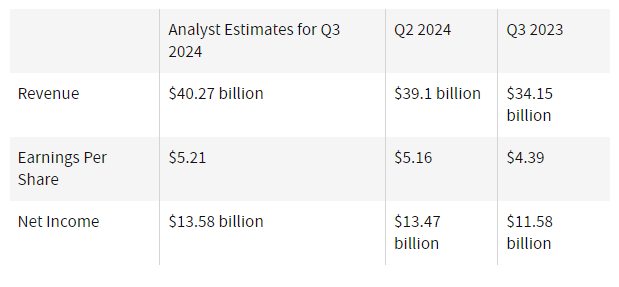

Analyst expectation from Meta result

Meta revenue and earnings

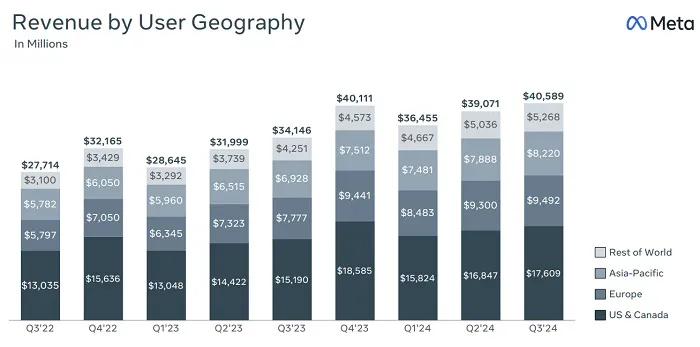

Meta's total revenue for Q3 2024 reached $40.59 billion, marking a significant 19% increase year-over-year.

This figure surpassed analysts' expected revenue projected of $40.25 billion.

In terms of profitability, Meta reported a net income of $13.56 billion, or $5.20 per share. This is an substantial improvement from the same period last year when the company posted $11.58 billion in net income, or $4.39 per share.

Revenue Breakdown

Here's how the revenue was distributed across Meta's main product segments:

Advertising Revenue: $39.91 billion

Adv represents the vast majority of Meta's revenue, coming from ads across its family of apps including Facebook, Instagram, and WhatsApp.

Reality Labs Revenue: $680 million

Includes sales of Meta's virtual and augmented reality hardware, software, and content

Other Revenue: Includes revenue from other sources such as payments and other fees.

Key drivers of growth

Several factors contributed to Meta's strong Q3 performance:

- AI-Driven Advertising Optimization: Meta has been leveraging artificial intelligence to enhance user engagement and improve its advertising business.

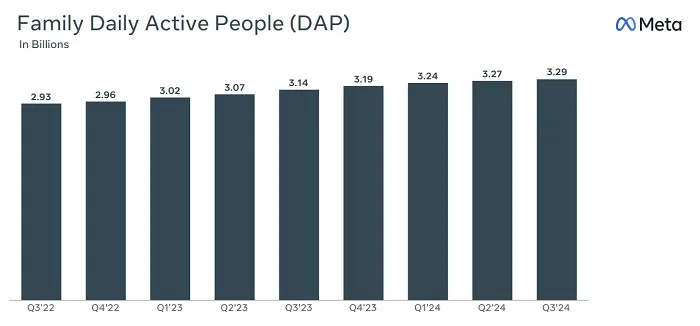

- Increased User Engagement: Meta's apps continue to attract a large user base. The focus on engaging younger users and improving core app usage has likely contributed to its revenue growth.

- AI Investments: Meta's commitment to AI development, including the release of its Llama 3.2 open-source AI model, positions the company as a strong competitor in the AI space.

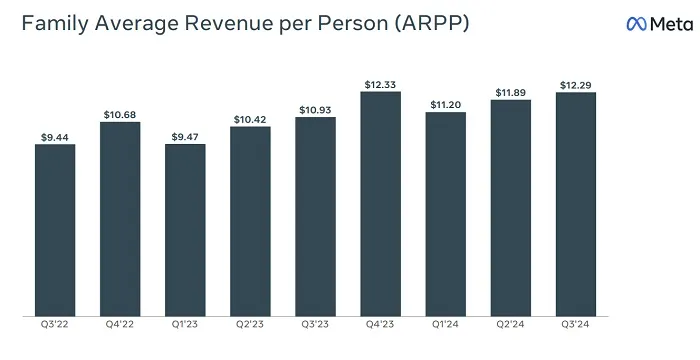

Meta’s also driving more revenue, on average, from those users:

Meta remains reliant on North America and Europe for the majority of its revenue intake, though it’s steadily increasing its Asia Pacific market intake as well

Market response and future outlook

Despite the strong Q3 results, Meta's stock experienced some volatility in after-hours trading.

This reaction was primarily due to the company's announcement of plans for increased spending, particularly in AI-related infrastructure. While this may impact short-term profitability, it demonstrates the company's commitment to long-term growth and innovation in the rapidly evolving tech landscape.

Conclusion

Meta's Q3 2024 results demonstrated the company's ability to generate strong revenue growth and maintain its position as a leader in the social media and digital advertising sectors.